Federal Reserve Interest Rates | The federal reserve announced that it's keeping interest rates steady following its jan. Count down to the next federal open market committee (fomc) rate hike with the cme fedwatch tool, based on the fed funds target rate. And how does it relate to interest rates? Interest rate in the united states is expected to be 0.50 percent by the end of this quarter, according to trading economics global macro models and analysts . Even though it's a fairly common term, what, exactly, does "inflation" mean?

Count down to the next federal open market committee (fomc) rate hike with the cme fedwatch tool, based on the fed funds target rate. Facing both turbulent financial markets and raging inflation, the federal reserve on wednesday indicated it could soon raise interest rates for . The federal reserve is getting ready to raise interest rates, the central bank said in its monetary policy update wednesday. The fed has maintained its target interest rate at 0% to 0.25% since march 15, 2020. Learn what to expect next.

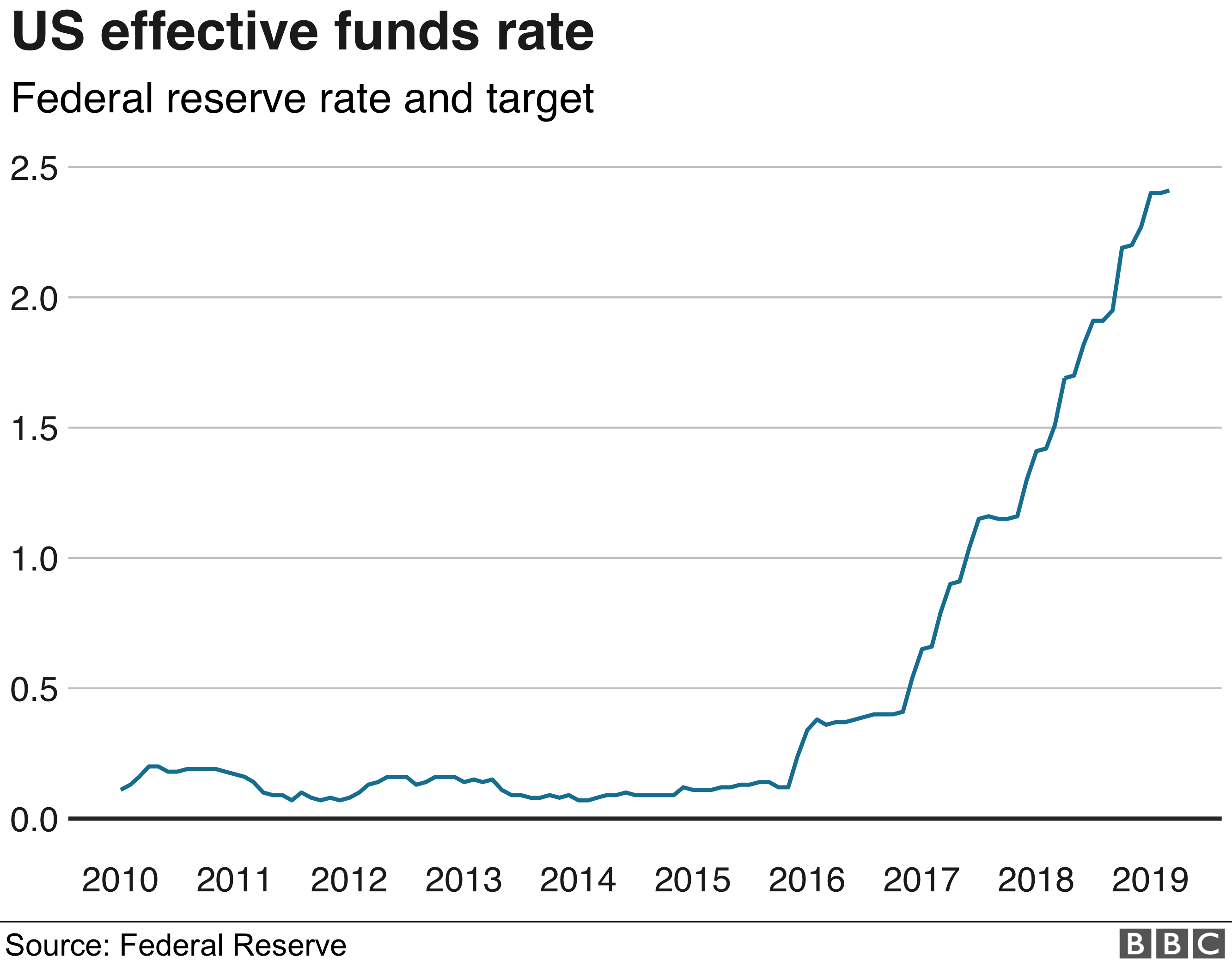

The term "inflation" has been all over the news lately — and it won't be the last time we hear it either. The fed has maintained its target interest rate at 0% to 0.25% since march 15, 2020. Learn what to expect next. View data of the effective federal funds rate, or the interest rate depository institutions charge each other for overnight loans of funds. Even though it's a fairly common term, what, exactly, does "inflation" mean? The federal reserve is getting ready to raise interest rates, the central bank said in its monetary policy update wednesday. Interest rate in the united states is expected to be 0.50 percent by the end of this quarter, according to trading economics global macro models and analysts . The level of these reserves is determined by the outstanding assets and liabilities of each depository institution, as well as by the fed itself, but is . Facing both turbulent financial markets and raging inflation, the federal reserve on wednesday indicated it could soon raise interest rates for . Here are some of the banks with the best interest rates for consumers. Fed interest rate decision ; The federal reserve announced that it's keeping interest rates steady following its jan. Fed chair jerome powell said the central bank would make a decision on the rate raise in its march meeting.

Learn what to expect next. Even though it's a fairly common term, what, exactly, does "inflation" mean? The federal reserve is getting ready to raise interest rates, the central bank said in its monetary policy update wednesday. The level of these reserves is determined by the outstanding assets and liabilities of each depository institution, as well as by the fed itself, but is . You work hard for your money, and you want your money to work hard for you.

The level of these reserves is determined by the outstanding assets and liabilities of each depository institution, as well as by the fed itself, but is . You work hard for your money, and you want your money to work hard for you. Facing both turbulent financial markets and raging inflation, the federal reserve on wednesday indicated it could soon raise interest rates for . Count down to the next federal open market committee (fomc) rate hike with the cme fedwatch tool, based on the fed funds target rate. View data of the effective federal funds rate, or the interest rate depository institutions charge each other for overnight loans of funds. The federal reserve is getting ready to raise interest rates, the central bank said in its monetary policy update wednesday. And how does it relate to interest rates? Learn what to expect next. Fed interest rate decision ; Interest rate in the united states is expected to be 0.50 percent by the end of this quarter, according to trading economics global macro models and analysts . Here are some of the banks with the best interest rates for consumers. In an ideal world, we would all find a way to make our money that is sitting in our banks work for us rather than, well, just sit there. The federal reserve announced that it's keeping interest rates steady following its jan.

The level of these reserves is determined by the outstanding assets and liabilities of each depository institution, as well as by the fed itself, but is . One of the ways we can do that is by placing our money in accounts that offer a decent annual percentag. The federal reserve announced that it's keeping interest rates steady following its jan. Interest rate in the united states is expected to be 0.50 percent by the end of this quarter, according to trading economics global macro models and analysts . The federal reserve is getting ready to raise interest rates, the central bank said in its monetary policy update wednesday.

Facing both turbulent financial markets and raging inflation, the federal reserve on wednesday indicated it could soon raise interest rates for . Learn what to expect next. The level of these reserves is determined by the outstanding assets and liabilities of each depository institution, as well as by the fed itself, but is . The federal reserve announced that it's keeping interest rates steady following its jan. Fed chair jerome powell said the central bank would make a decision on the rate raise in its march meeting. Here are some of the banks with the best interest rates for consumers. You work hard for your money, and you want your money to work hard for you. Fed interest rate decision ; Even though it's a fairly common term, what, exactly, does "inflation" mean? Interest rate in the united states is expected to be 0.50 percent by the end of this quarter, according to trading economics global macro models and analysts . In an ideal world, we would all find a way to make our money that is sitting in our banks work for us rather than, well, just sit there. The term "inflation" has been all over the news lately — and it won't be the last time we hear it either. Count down to the next federal open market committee (fomc) rate hike with the cme fedwatch tool, based on the fed funds target rate.

Federal Reserve Interest Rates! The federal reserve announced that it's keeping interest rates steady following its jan.

No comments

Post a Comment