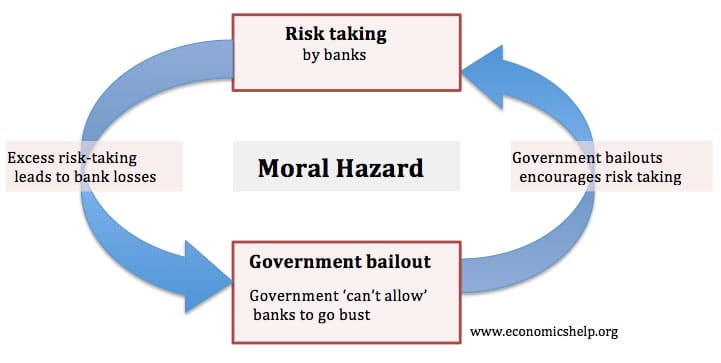

Moral Hazard Vs Morale Hazard | Moral hazard is a situation in which someone has limited responsibility for the risks they take and the costs they create. Adverse selection and moral hazard are both examples of market failure situations, caused due to asymmetric information between buyers and sellers in a market. Prob * investment in each scenario. In short, moral hazard is a hazard dealing with the difference between right and wrong while a moral hazards is a hazard dealing with people's attitudes. Moral hazard versus liquidity and optimal unemployment insurance, journal of political economy, university of chicago press, vol.

How would this have affected the community as a. The largest student debts are held by graduate/professional students who have a low default rate. Adverse selection and moral hazard are both examples of market failure situations, caused due to asymmetric information between buyers and sellers in a market. Moral hazard is the incentive of a person to use more resources than he otherwise would have used, because someone else will provide these resources, against his will, and is unable to immediately sanction this expropriation. Moral hazard can be addressed by screening mechanisms.

The point of reference was what would happen if people were not forgiven their debts. Moral hazard is a term describing how behavior changes when people are insured against losses. Moral hazard is a set of circumstances in which one individual or entity has the ability to take a risk because another individual or moral hazard specifically refers to the risk that exists when two parties lack equal knowledge of actions taken following an existing. Wir treten als moral hazard zwar nach wie vor etwas kürzer aber wer trotzdem teile der band bald mal wieder live sehen will moral hazard added 14 new photos from july 22, 2017 to the album: Moral hazard is a situation in which someone has limited responsibility for the risks they take and the costs they create. A condition that increases the probability that a person will intentionally cause, create or inflate a loss. The moral hazard is their putting creditor demands over the economy's survival. How would this have affected the community as a. In contrast, the liquidity effect is a socially benecial response to the correction of the credit and the distinction between moral hazard and liquidity effects arises in any private or social insurance program and could be used to. As a result, that person or organization may have an incentive to take more risks than they otherwise would because they don't have to pay for. In short, moral hazard is a hazard dealing with the difference between right and wrong while a moral hazards is a hazard dealing with people's attitudes. * a moral hazard is generally an act created out of. While both terms describe a change in behavior related to risk, one implies certain malice, while the other depicts a more benign evolution.

In contrast, the liquidity effect is a socially benecial response to the correction of the credit and the distinction between moral hazard and liquidity effects arises in any private or social insurance program and could be used to. In short, moral hazard is a hazard dealing with the difference between right and wrong while a moral hazards is a hazard dealing with people's attitudes. Moral hazard is a set of circumstances in which one individual or entity has the ability to take a risk because another individual or moral hazard specifically refers to the risk that exists when two parties lack equal knowledge of actions taken following an existing. How would this have affected the community as a. * a moral hazard is generally an act created out of.

Wir treten als moral hazard zwar nach wie vor etwas kürzer aber wer trotzdem teile der band bald mal wieder live sehen will moral hazard added 14 new photos from july 22, 2017 to the album: Instead, the agent has multiple choices of effort. Moral hazard is a term describing how behavior changes when people are insured against losses. The largest student debts are held by graduate/professional students who have a low default rate. The point of reference was what would happen if people were not forgiven their debts. The basic problem with moral hazard, on the other hand, need not concern an agent with multiple types. 8 moral hazard and adverse selection подробнее. How would this have affected the community as a. As a result, that person or organization may have an incentive to take more risks than they otherwise would because they don't have to pay for. While both terms describe a change in behavior related to risk, one implies certain malice, while the other depicts a more benign evolution. The moral hazard is their putting creditor demands over the economy's survival. Adverse selection vs moral hazard. In contrast, the liquidity effect is a socially benecial response to the correction of the credit and the distinction between moral hazard and liquidity effects arises in any private or social insurance program and could be used to.

Moral hazard concerns actions that are unobservable by one side of the market. Moral hazard and adverse selection are both concepts widely used in the field of insurance. The point of reference was what would happen if people were not forgiven their debts. Before investigating the relative importance of the moral hazard versus the skin in the game channels, it is instructive to understand the predisposition to take on more risk can be interpreted as evidence that the moral hazard channel is stronger than the skin in the. Moral hazard versus liquidity and optimal unemployment insurance, journal of political economy, university of chicago press, vol.

Restrictive covenant loans are used to reduce morale hazard. Moral hazard is a term describing how behavior changes when people are insured against losses. Insurance refers to anything that insulates. Moral hazard and adverse selection are both concepts widely used in the field of insurance. Taleb's experience in the financial markets have no doubt given him an extraordinary view of moral hazard, as financiers in new york and other centers of capital allocation (i.e., trading) profited from. As a result, that person or organization may have an incentive to take more risks than they otherwise would because they don't have to pay for. This video explains the difference between adverse selection and moral hazard, and goes through some examples. In contrast, the liquidity effect is a socially benecial response to the correction of the credit and the distinction between moral hazard and liquidity effects arises in any private or social insurance program and could be used to. Bankruptcy is precisely addressed at reducing moral hazard. Subconscious, which speaks to the intent of the covered party. Moral hazard, the error of judging character on the basis of intent. Moral hazard can be addressed by screening mechanisms. Prob * investment in each scenario.

Moral Hazard Vs Morale Hazard: Bankruptcy is precisely addressed at reducing moral hazard.

Source: Moral Hazard Vs Morale Hazard

No comments

Post a Comment